Business Forecast Reveals Stark Dichotomy: New Survey from Altum Strategy Group Exposes Growing Divide On Corporate Risks and Opportunities in 2024

C-Suites Cite Economic Conditions As Three Times More Challenging Than Tech Advancements, Regulatory Environment and Competition

NEW YORK, January 24, 2024 – A new survey from Altum Strategy Group, in partnership with YouGov, revealed C-Suite executives perceive challenges from economic conditions on revenue, risk, and profit as almost three times that of technological advancements, regulatory environment, and competitive landscape. Fielded in December 2023, the survey comprises 533 C-suite leaders in the United States.

The survey, which ranked external factors posing the most challenges in 2024, showed that over 1 in 2 C-suite leaders are concerned about the economy affecting revenue, risk, and profit this year, and nearly one-third view operational efficiency as a business risk for 2024. A third prioritize technology advancements as a top-two factor impacting revenue; 3 in 10 said the regulatory environment poses a risk to business and profitability.

“In 2023, companies faced strong economic headwinds, and they are still feeling the impact heading into 2024. The data shows that the size and age of an organization often dictates leadership priorities to avert risk, recognize growth opportunities, and maximize profits,” said Matthew Gantner CEO, Founder of Altum Strategy Group. “There is no one-size-fits-all strategy, and business leaders need to focus on what will drive their resilience in the next 12 months.”

Revenue

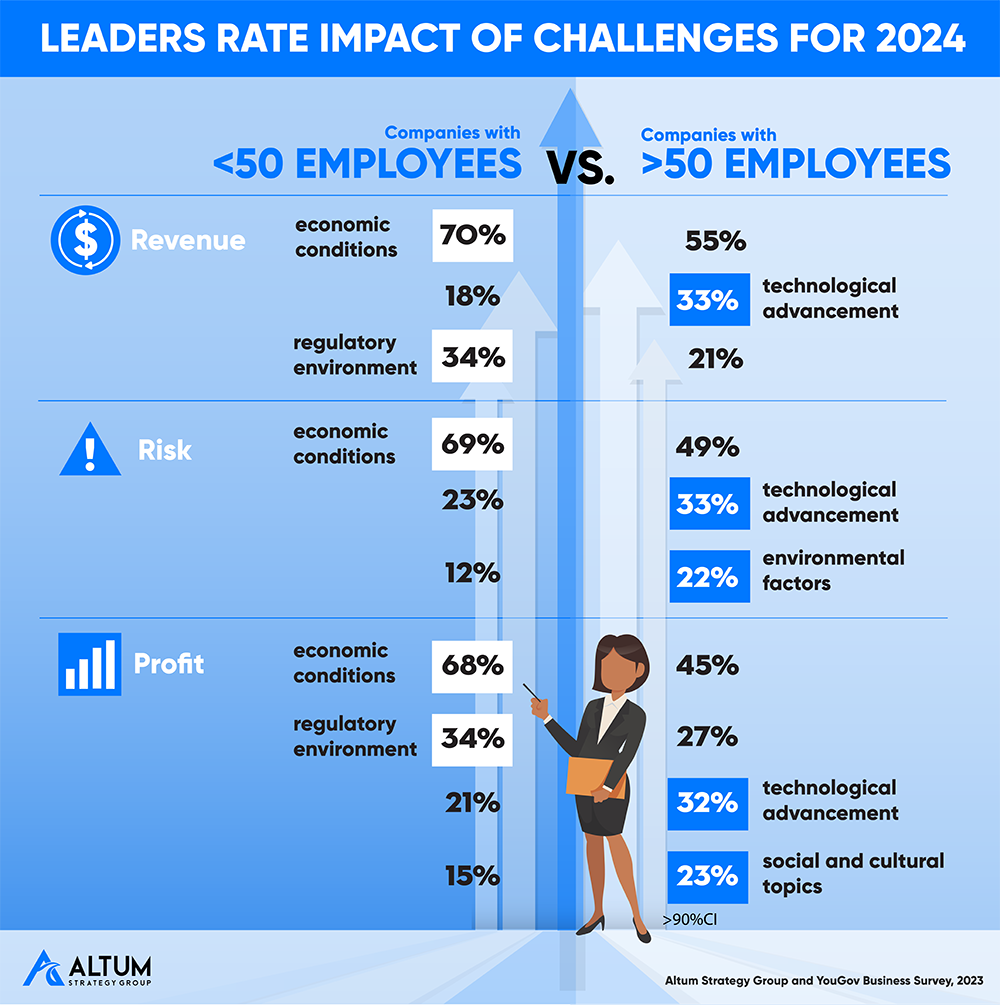

There is a divide among leaders of businesses with more than 50 employees vs. those with less than 50. 7 in 10 business leaders of companies with less than 50 employees rank economic conditions in their top two challenges to achieve business revenue targets in 2024, versus 55% of leaders with more than 50. employees who are almost twice as likely to note technological advancement as a challenge (33%) compared to 18% with less than 50. Additionally, nearly 1 in 3 leaders in larger companies view innovation and adaptability as top factors impacting revenue targets, while leaders managing businesses with 50 or fewer employees rate the regulatory environment as a challenge to achieve revenue targets (34%).

The survey also revealed that different leadership roles within an organization are prioritizing different challenges to achieving revenue targets. Leaders in managing director and owner roles are more likely to place higher importance (top 2) on economic conditions (67% and 66%, respectively). In contrast, partner/chief executive/CEO roles are more likely to emphasize technological advancement (33%) and competitive landscape (27%).

Additionally, on average, C-Suite leaders managing businesses with less than 20 years of operating tenure rate the impacts of technological advancements on business revenue in 2024 higher (34%) compared to older businesses (22%). Conversely, leaders managing businesses with over 20 years of tenure rank regulatory environment (33%) higher than younger businesses (20%).

Risk

All businesses see economic conditions as a risk to business, with smaller businesses ranking it at 69% versus larger businesses at 49%. Larger businesses also consider technological advancement (33%) and the environment (22%) as significant factors affecting their company risk.

Executive roles play a big part in how businesses assess risk, with the survey showing leaders in ownership roles are more concerned with economic conditions (63%) compared to those in chair/chief executive roles who are likelier to note technological advancements (34%) as a bigger risk.

Business age is also impacting risk assessment. Leaders managing companies operating for 20 years or longer are more likely to rank economic conditions (61%) and regulatory environment (34%) as higher risk, while leaders in younger businesses (< 20 years) rank technological advancement (34%) higher.

Profit

For 2024, more C-Suite leaders managing larger businesses rank technological advancements (32%) and social and cultural topics (23%) as challenging factors to achieving profitability targets, while leaders managing smaller companies are much more likely to rank economic conditions (68%) and regulatory environment (34%) as a top challenge.

The survey revealed that different sectors are facing unique challenges to achieving profitability targets, with leaders in the Asset sector more likely to rank social and cultural topics in their top 2 (25%) than those in the Service (16%) sector and the Knowledge sector (21%). Conversely, leaders managing Service and Knowledge-based industries are more likely to rank regulatory environment (31%) higher than those in Asset-based industries (23%)

Older companies face different challenges to profitability than younger companies. Business leaders of older companies are more likely to rank economic conditions (61%) and competitive landscape (34%) higher, and leaders in younger businesses rank technological advancement (34%), environmental factors (25%), and geo-politics (23%) as the most important factors.

Survey results can be found at Altum US Business Leaders Survey December 2023

About Altum Strategy Group

Altum delivers the next technology wave to clients in a tailored way to empower teams and create value. Thinking boldly, deploying inclusive collaboration and active engagement is how we work. Altum applies our diverse expertise to lead strategy development at all levels, enabling us to incorporate cutting-edge digital solutions and innovative business operations that deliver impactful results. Altum powers our clients and their teams so they can ride the current wave and anticipate the next one.

# # #

Media Contact:

Ms Suzanne Lyons Phone: +1 201 647 9421 or media@confidentstrategygroup.com

- Date January 24, 2024

- Tags Insights, Strategic Growth & Digital Transformation Insights